In this edition of Ad Formats, we look at how platforms including Lyft and Disney+ are increasingly converting user behaviour into bookable surfaces, how LinkedIn is breaking out of the desktop, how TikTok in the US may have to carry on without its algorithm, and how height now matters on X.

ByteDance: Reach without rhythm

What is it? TikTok parent-company ByteDance is preparing to spin off a US-only version of the app — internally codenamed ‘M2’ — in response to federal divestment laws, scheduled to take effect on 5 September. ByteDance is expected to retain a minority stake in the app, while a US-led group, which reportedly includes Oracle, takes over majority ownership.

What good is it? That depends on what gets ported over. ByteDance has indicated its core algorithm won’t be included in the handoff. Without the ranking engine that powers TikTok’s predictive feed and media performance, M2 could resemble a TikTok-shaped shell: same UI, different tempo.

Platform logic, not platform look: Planners may need to treat M2 not as a fork in policy, but a fork in product logic. If discovery weakens, so does demand. In a media plan, velocity often beats volume.

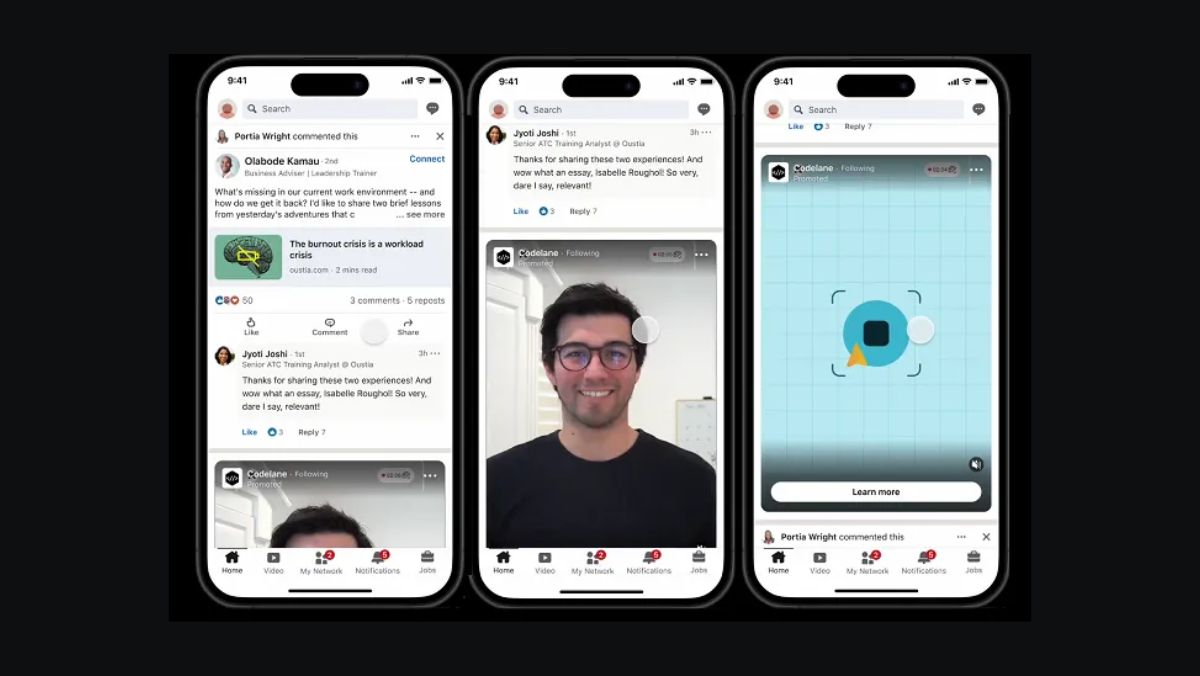

LinkedIn: B2B gets broadcast ambition

What is it? LinkedIn has unveiled a full stack of upgrades aimed at B2B video relevance. First Impression Ads secure a user’s first ad slot each day: full-screen, vertical and reserved. Reserved Ads offer premium feed placement for formats like Thought Leader posts and Document Ads. CTV Ads, already live in the US and Canada, expand LinkedIn’s reach into living rooms via Paramount content, with Innovid handling creative management and VAST tag support.

What good is it? These upgrades reposition LinkedIn as more than a desktop destination. First Impression and Reserved Ads let brands cut through clutter at the moments users are most receptive, while CTV placement helps marketers bridge the creative gap between B2B intent and consumer polish.

Boardroom meets broadcast: A new Adobe Express integration rounds out the update, enabling brands to create LinkedIn-ready video directly in-platform. Taken together, it’s a shift from social selling to media planning, with every stage — from asset creation to screen distribution — now fully supported.

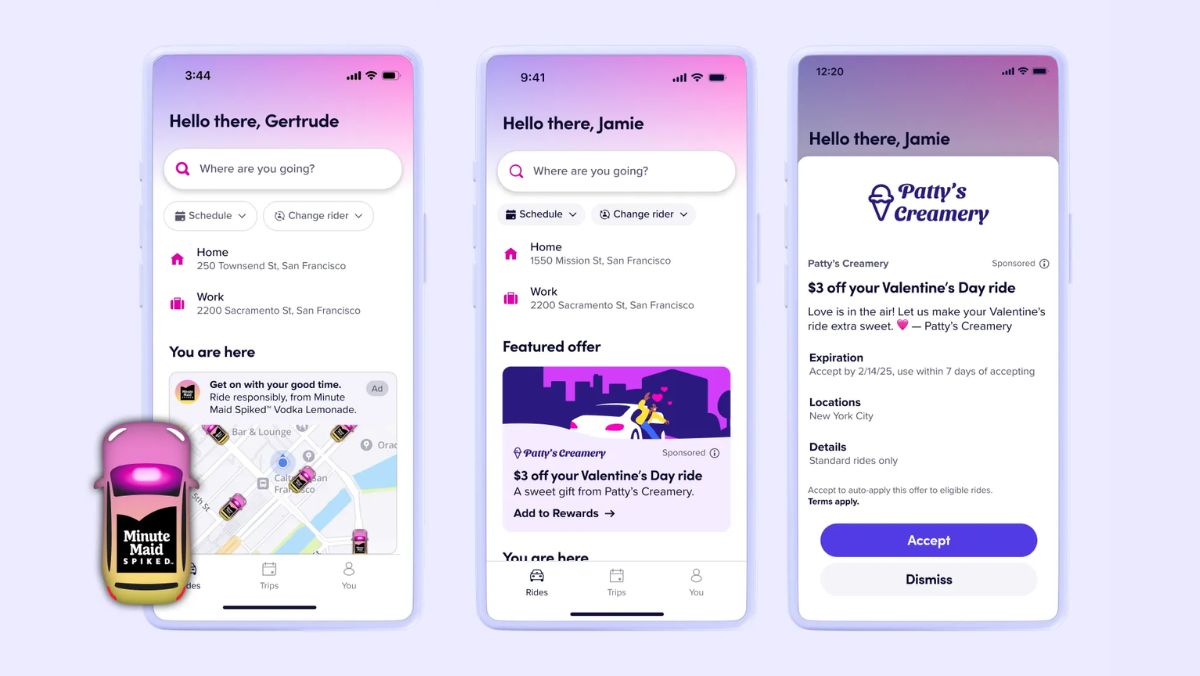

Lyft: From map to moment

What is it? Lyft’s latest ad rollout introduces three experience-native formats. Sponsored Map Vehicles offer a branded takeover of Lyft’s in-app map, with custom vehicle icons and optional (real life) car wraps. Sponsored Rides let brands subsidise rides (standard or priority), with co-branded elements visible from homepage to drop-off. Full-screen Vertical Video ads now appear during the Wait and Save option, targeting riders as they wait for their cheaper fare. All formats are verifiable through IAS and DoubleVerify.

What good is it? The average Lyft user clocks 24 minutes per ride, so why not turn that downtime into ad time? Each format captures a different commuter ritual: checking the map, waiting for a ride, scrolling en route. For media planners, it’s OOH with a retargeting backbone — except the billboard moves, the screen scrolls and the ad knows where you’re headed.

Commuter time, commercialised: Sponsored Rides offer nationally scalable real-world utility, served with a measurable media layer. Uber still leads on revenue, but Lyft’s challenger posture invites creative ambition.

Disney: Shoppable storytelling gets a snack break

What is it? Disney’s newest formats tap into two distinct viewer impulses: style envy and snack cravings. Shop the Stream is a second-screen experience powered by Shopsense AI, letting users buy outfits and items featured in the show they’re watching. Virtual Concessions, meanwhile, lets viewers order snacks, drinks and sweets during ad breaks, fulfilled in real time by Gopuff. Both formats run across ESPN, Hulu and Disney+.

What good is it? With precise clean room targeting and timed delivery windows, Disney is packaging behavioural cues — bingeing, browsing, pausing — into commercial prompts. For brands, it means converting mood into purchase intent, in-platform.

Entertainment as e-commerce engine: Amazon has the checkout muscle, but Disney’s play is narrative alignment. Shoppable episodes move beyond product placement to become story-enhanced storefronts. It’s CTV made measurable with moments you can buy.

X: Size now sets the price

What is it? In a bid to rein in visual sprawl, X will soon charge advertisers based on the vertical screen real estate their creatives occupy. A full-height ad will cost more than a quarter-height unit. Simultaneously, the platform is removing hashtags and branded hashmojis from paid posts, citing user fatigue and cluttered timelines.

What good is it? Ad format costs are now directly tied to user comfort. Rather than punishing low engagement post-hoc, X is preemptively pricing intrusiveness. For planners, it offers rare control over attention-to-cost ratios and nudges creatives toward subtler builds.

Reformatting the feed: While platforms like YouTube and TikTok already bake impact into pricing, X’s approach is more architectural: designing UX back into the buy. It’s a clean-up job and a signal that screen space is once again premium real estate.

Featured image: Arno Senoner / Unsplash