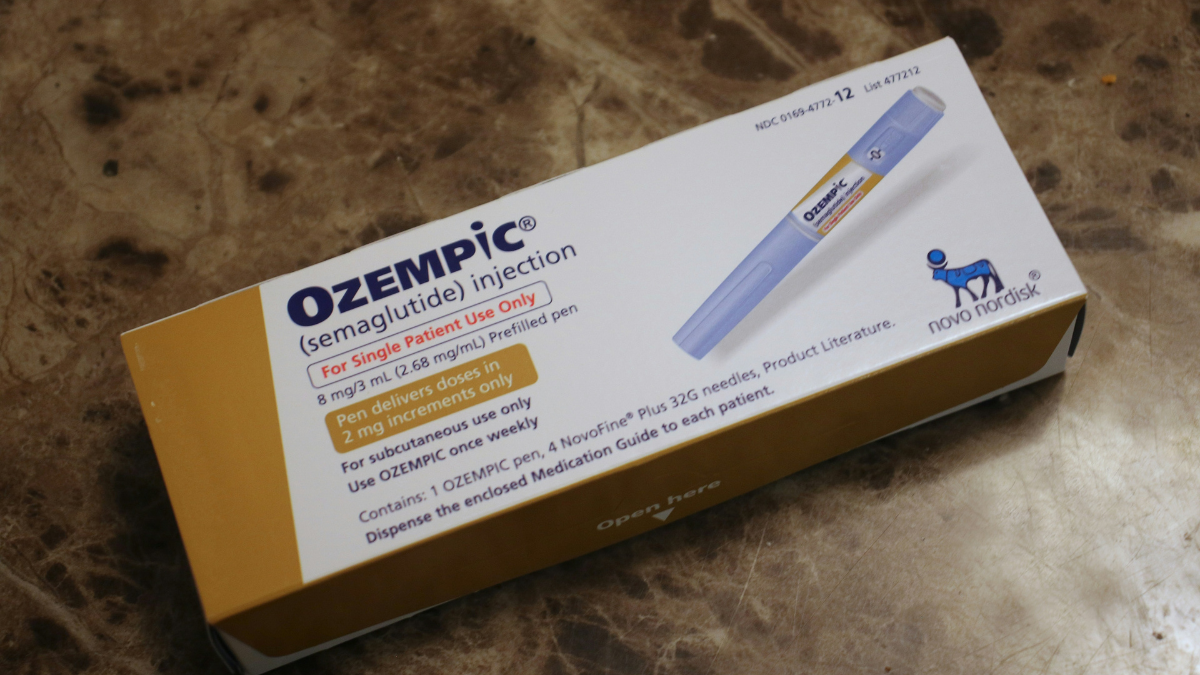

Brands must prepare for the ‘GLP-1 revolution’, thinks Havas Health Network’s global chief strategy officer and head of growth, Brian Robinson.

Speaking at MAD//Fest last week, Robinson said one in eight people in the US has taken or is taking GLP-1 agonists like Ozempic, Wegovy, and Mounjaro, and the number of users is estimated to increase by 20% over the next five years.

Already, grocery shopping has declined 6.1% in the US, as people’s appetites drop and they turn to smaller portions, Robinson said. In the UK, Kantar reported that grocery volumes fell by 0.4% over the four weeks to 15 June and that the drop could be owed to GLP-1 drugs as four in 100 households now include ‘at least one GLP-1 user’.

But these medications do more than just help people lose weight, Robinson said: they’re changing people’s consumption habits and ‘creating ripple effects across other categories’.

Robinson said that both the travel and fitness industries in the US have grown, as weight loss drugs boost people’s confidence and enable them to engage in new activities. There has also been a 295% increase in dating and a 200% growth in people seeking therapy to cope with the changes they’re undergoing.

Robinson argued that brands ‘need to do insight work to figure out how they can tap into the GLP-1 audience’. To this end, Havas Health Network opened a consultancy earlier this year to help brands adapt to and take advantage of the effects of weight-loss drugs.

In May 2024, Nestlé introduced a new food line called Vital Pursuit, designed specifically for people taking GLP-1 agonists.

In a press release, Nestlé North America’s CEO Steve Presely said that the drugs’ popularity presented the brand with ‘an opportunity’ and that the brand is ‘leveraging [its] deep understanding of consumers and nutritional science to stay ahead of the trends that are shaping consumer behaviours.’

But Andy Wardlaw, chief ideas officer at MMR Research, said there are opportunities beyond food brands introducing smaller portion sizes and healthier alternatives.

‘The good news for manufacturers is that humans are motivated by more than just immediate sensory pleasure,’ he said. ‘As behavioural research shows, deeper emotional drivers, like belonging, vitality, adventure, or responsibility, play an equally powerful role in what we choose to buy.’

He added that while weight loss drugs can ‘dull the dopamine rush of a cookie or a cocktail’, they ‘don’t touch the desire to feel confident, connect with others, or express identity.’

He advises brands to take a step back and shift their mindset, ‘from exploiting cravings to engineering motivation.’ According to Wardlaw, brands can succeed by tapping into these ‘richer, more resonant sources of reward.’

But should brands really put their money into new marketing strategies, product lines, or even GLP-1 consultancies?

Shauna Moran, data journalist at GWI, confirmed that many industries are likely to see a ripple effect, but said brands ‘shouldn’t rush in blindly.’

‘Any strategic tweaks to their products or marketing should be guided by whether current or potential users make up a meaningful slice of their customer base,’ she added.

Moran argued that fitness brands have a ‘clear opportunity to step up’ as GLP-1 users turn to strength training to ‘offset muscle loss’. Additionally, GWI found that 32% of consumers who buy sports clothing or equipment either take weight loss drugs or are interested in doing so.

‘Meanwhile, interest [in GLP-1 drugs] and engagement drop to 24% among those who buy breakfast cereal, so “GLP-1 friendly” labels on these boxes may not perform as well as on other products,’ Moran said.

According to GWI’s data, 18% of GLP-1 users have ‘spotted negative side effects’, added Moran, which could ‘take some wind out of the trend’s sails’.

Featured image: David Trinks / Unsplash