Google’s parent company, Alphabet, reported strong results in its Q1 2025 earnings call on 24 April.

CFO Anat Ashkenazi said consolidated revenues grew to $90.2 billion and increased by 12% or 14% in constant currency year-on-year. She added that Google Search, YouTube advertising, subscriptions, and Google Cloud all reported double-digit revenue growth.

CEO Sundar Pichai said Alphabet is ‘pleased with [its] strong results’ and that it continues to see ‘healthy growth and momentum across business, including AI powering new features.’

These features are drawing companies in, as senior vice president and chief business officer for Google, Philipp Schindler, said businesses of all sizes are ‘adopting AI-powered campaigns.’

‘Throughout 2024, we launched several features that leverage LLMs to enhance advertiser value, and we’re seeing this work pay off. The combination of these launches now allows us to match ads to more relevant search queries and this helps advertisers reach customers and searches where we would not previously have shown their ads,’ he said.

The company has grown in search, following its release of AI Overviews and, more recently, AI Mode. Pichai shared that AI Overviews now has more than 1.5 billion monthly users while AI Mode — which Alphabet started experimenting with in March — is receiving early positive feedback.

From audience insights to demand generation

Schindler explained that Alphabet is ‘infusing AI into every step of the marketing process’, from audience insights and creative, to media buying and demand generation.

Specifically, it is facilitating audience insights by allowing advertisers to see which themes ‘resonate most with their top audiences’. It is also enhancing the creative process with more advanced image-generation technology, which allows advertisers ‘to generate a broader variety of lifestyle imagery customised to their business.’

‘On media buying, advertisers continue to see how AI-powered campaigns help them find new customers. In demand gen, advertisers can more precisely manage ad placements across YouTube, Gmail, Discover, and Google Display Network globally, and understand which assets work best at a channel level,’ Schindler said.

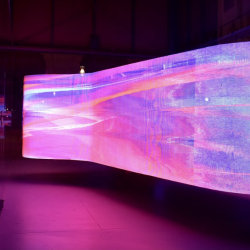

YouTube is thriving

YouTube, which turned 20 on 23 April, increased both ad and subscription revenue in Q1. Pichai also said that, according to Nielsen, the platform has ranked first in streaming watch time in the US for two years.

Schindler claimed that creators are driving this viewership, uploading an average of 20 million videos daily: ‘Our biggest creators generate a level of fandom and viewer engagement around large cultural moments on YouTube that brands can’t find anywhere else. During March Madness, brands aligned not only with clips and highlights from the game but also with the creators who drive basketball culture, like Jesser and The Ringer’s J. Kyle Mann.’

An analyst questioned whether brands on YouTube are ‘holding up relatively well’ or whether they’re reacting to what he called ‘macro jitters’. Schindler said that both brand and direct response advertising had ‘a very solid growth’ in the first quarter, particularly with advertisers joining in on culture moments such as Coachella and March Madness.

‘The operating metrics for YouTube were strong in Q1. Watch time growth remains robust, particularly in key monetisation opportunity areas such as shorts and living room,’ he added.

During the call, Schindler also said that reservation-based ads on YouTube (whereby advertisers buy specific media placements on a fixed, cost-per-thousand-impressions basis) more than doubled year-on-year in the first quarter.

He also briefly mentioned Roblox’s partnership with Google Ad Manager: ‘Gen Z gamers are Roblox’s biggest users. And thanks to our partnership, advertisers will be able to reach this audience with ads that lend seamlessly into the gaming experience.’

Featured image: Kai Wenzel / Unsplash