The internet trends reports that VC Mary Meeker wrote when she was at Kleiner Perkins were essential reading for the ad industry. She’s at her own firm (Bond) now, and she’s writing about artificial intelligence, too, but her reports are no less vital.

They are, however, very long. Bond’s 2025 Trends — Artificial Intelligence report runs to 340 slides. So we’ve done the hard reading and selected six key findings on the state and likely direction of AI.

AI adoption is booming

It’s no secret that AI adoption is on the rise, but the speed at which ChatGPT’s user base is growing may still surprise.

According to the report, ChatGPT achieved 365 billion annual searches just two years after its release; in comparison, it took Google 11 years. It also took the AI chatbot just 0.2 years to reach 100 million users, whereas it took Facebook and Netflix 4.5 and 10.3 years, respectively. ChatGPT’s weekly active users also increased eightfold over a recent seventeen-month period (between October 2022 and April 2025) to 800 million.

Last year, Morgan Stanley found that 75% of CMOs were either experimenting with or had fully implemented AI tools in their operations. But it’s not just CMOs that are adopting the technology. Developers are also increasingly turning to AI tools, with over 7 million of them using Gemini in May 2025 — a fivefold increase from May 2024.

AI models are cheap to use but expensive to train

Although AI adoption is booming, Bond reported that there is ‘mounting tension between capabilities and costs’.

Specifically, training costs have increased around 2,400 times over eight years (2016-2024) and are still growing quickly. On the other hand, inference costs (ie, the cost of running the AI models) dropped by 99.7% between 2022 and 2024. This drop, the report explains, is owed to ‘massive improvements in both hardware and algorithmic efficiency’ and is driving ‘competitive pressure amongst LLM providers’.

This is good news for users who can access the technology at a low cost, but raises concerns for AI model providers that need to monetise.

Monetisation opportunities

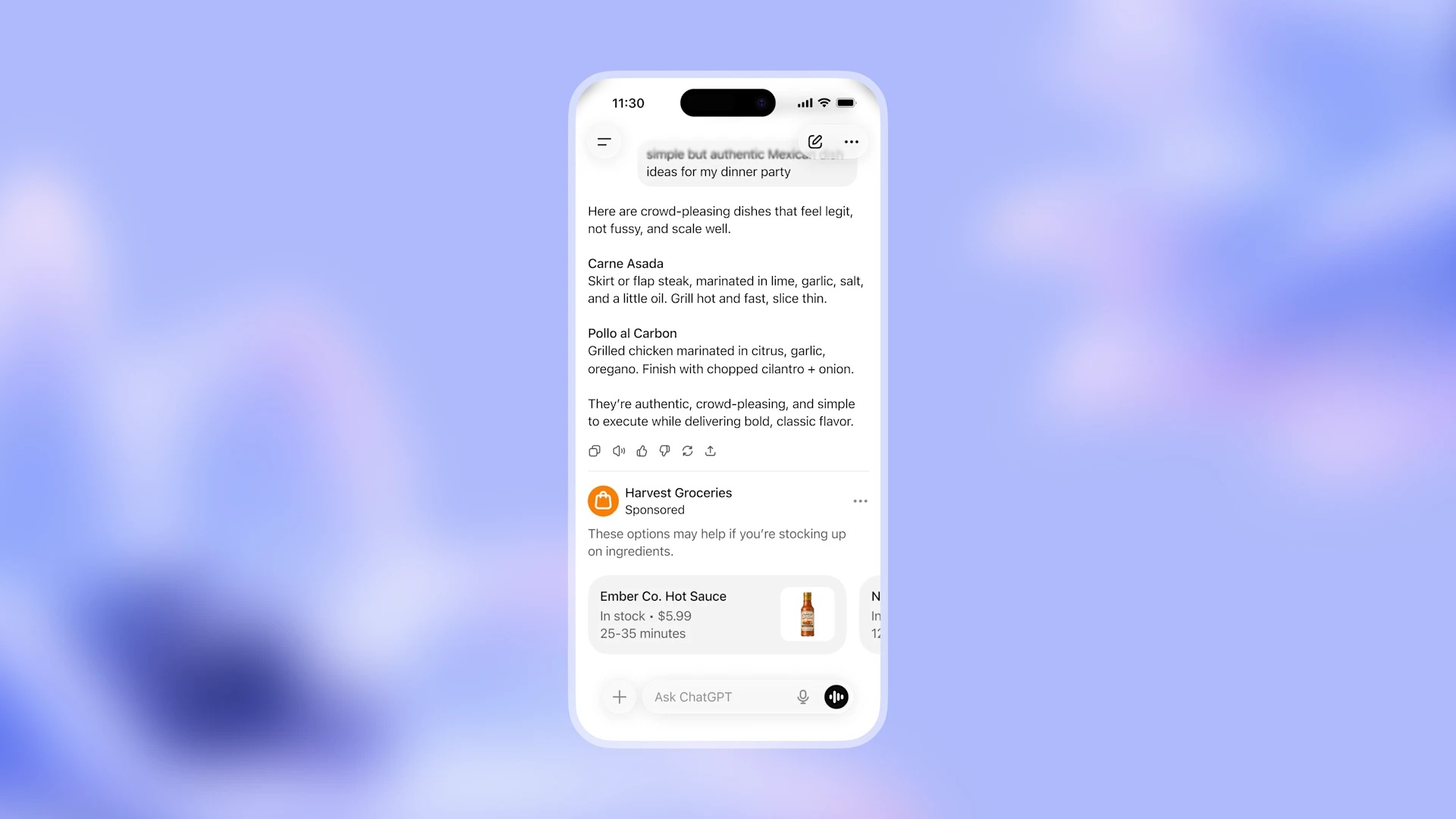

AI provider monetisation options include consumer subscriptions, developer API fees, digital services, and ads. OpenAI’s revenue grew to $3.7 billion between October 2022 and April 2025, with ChatGPT recording 20 million paid subscribers over the same period. Meanwhile, Google introduced sponsored ads to some of its AI overview responses last month, signalling good news for advertisers.

AI is also bringing monetisation opportunities to horizontal enterprises that cater to a wide range of industries with products/services and specialist vendors (or vertical companies) that focus on a specific industry.

‘Horizontal enterprise platforms could usher in a new form of monetisation: not by selling siloed software licenses, but by charging for intelligence, embedded throughout the stack,’ the report authors write, citing examples such as Microsoft’s Copilot and Canva’s AI integration.

Specialist vendors can embed AI tools that are trained on ‘proprietary industry data’ and can deploy ‘domain-specific intelligence’. The authors argue that these vendors can ‘roll out AI as a feature, not a product, and monetise it’ without changing the customer buying journey.

‘Horizontal platforms will push breadth, stitching together knowledge across functions; specialists will push depth, delivering AI that speaks the language of compliance, contracts, and customer intent,’ the report predicts.

Fierce competition: closed vs open source

OpenAI’s ChatGPT is the strongest AI chatbot, with 5.1 billion site visits between May 2024 and April 2025. Closed models (such as ChatGPT) dominate since they offer users ‘name recognition, fast onboarding and polished UX’. They’re also popular with enterprises because ‘they promise security and ease of use for non-technical employees.’

That said, there was a 1,150% increase in the number of multimodal AI models (ie, models that can understand and generate texts, images, audio and video content) released between 2022 and 2024. And, open-source models are rapidly ‘closing the gap’. The report claims that open-source models like Llama 3 and DeepSeek are gaining popularity because of their ‘competitive reasoning, coding, and multilingual abilities’. In addition, they are ‘fully downloadable, fine-tuneable and deployable on commodity infrastructure’.

In other words, they are ideal for developers who seek ‘raw capability, customisation and cost efficiency.’ The report warns that this is important because developers are the ones ‘who have historically been the leading edge of AI usage.’

China’s LLMs are strong

DeepSeek is not the only Chinese AI startup that is performing well. The report notes that Chinese LLMs are ‘catching up’ to US models, with the two countries outperforming the rest of the world.

LLMs like DeepSeek are competing with US models such as ChatGPT but have significantly lower training costs. Chinese users are also using local models at scale — largely because they do not have access to foreign chatbots.

They do, however, have a more positive view of AI products and services than the rest of the world, with 83% of Chinese users saying AI offers more opportunities than drawbacks in 2024. This percentage increased from 78% in 2022 and is significantly higher than the US’ 39%.

Looking ahead

People are increasingly talking about AI agents, with Bond reporting a 1,088% increase in Google searches relating to the topic over the past 16 months. But beyond AI agents, we are also seeing more ‘physical agents’ as AI begins powering autonomous vehicles and other machines. In the future, expect more organisations to focus on Artificial General Intelligence (AGI), which aims to match or exceed human cognitive abilities.

Featured image: Mariia Shalabaieva / Unsplash