The global market for vertical/micro dramas is projected to reach $14 billion by 2027, nearly three times what it was worth two years ago.

The format — one-minute episodes made to be viewed vertically on a mobile phone screen — first made its mark on the audiovisual market in China during the pandemic, when platforms like Douyin and Kuaishou helped push it into the mainstream.

Since then, the genre has gained some global momentum, generating over $100 million a month in the US alone.

ReelShort, the most prominent player in the US market, is backed by Beijing’s COL Group and operates out of California. In Q1 2024, it accounted for over a third of short-drama app revenue globally. In late 2024, it briefly overtook TikTok on Apple’s US entertainment chart, and has since surpassed 30 million downloads.

Studios are starting to pay attention, too. Lionsgate and TelevisaUnivision are now developing their own vertical dramas, and talent agencies are signing actors from breakout titles.

For creators, the appeal is increasingly obvious: a format that’s fast, data-driven and comparatively cheap to produce.

Conversion-first content

At 60-90 seconds an episode, duanjus (Chinese for micro-dramas) afford little time for narrative depth, and that’s the point.

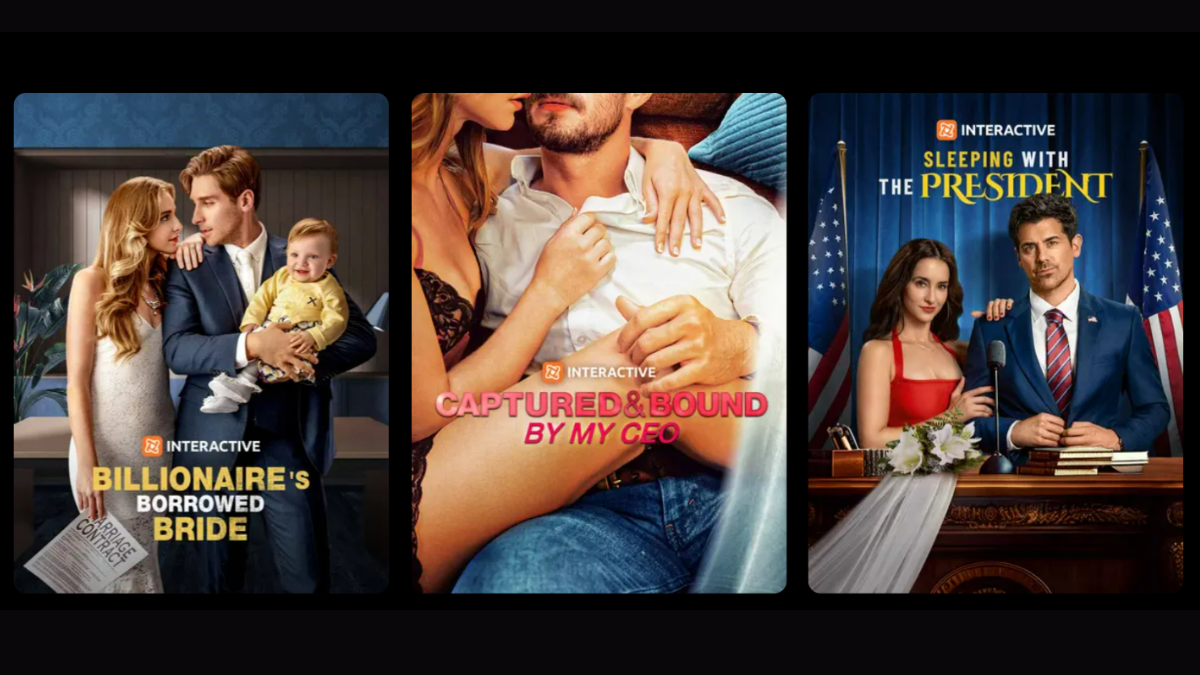

Melodramatic, soapy and sometimes smutty, titles like Claimed by the Alpha I Hate and The Heiress Blacklisted Her Husband don’t just telegraph the plot, they sell it in five words or less.

The tropes are familiar — secret heirs, enemies to lovers, contract marriages — and tap into a logic BookTok fans will recognise. Some scripts originate on My Fiction, a self-publishing platform owned by Crazy Maple Studio, while others are developed in-house.

Because it’s mobile-native, it feels intuitive to the generation raised on infinite scrolls; even if the core audience (for now) is older than expected. Crazy Maple, the studio behind ReelShort, says most of its viewers are millennial and middle-aged women. That’s likely to change soon, though, as male-targeted storylines, influencer casting and creator funds are already pulling new audiences in.

‘Some people said: “I can’t believe someone would pay for this,”‘ Joey Jia, head of Crazy Maple, told the Washington Post. ‘Our answer is: You think you understand the entire entertainment market? You don’t.’

Structurally, the format isn’t trying to mimic TV. It’s built around mobile attention thresholds: the first few episodes are free, but paywalls kick in when the algorithm predicts a user is likely to convert. If that prediction shifts, the content gets re-edited. If drop-off spikes, entire story arcs are re-shot.

Companies may spend between $300,000 and $500,000 to re-shoot underperforming shows post-launch to boost engagement. And shows often end on a cliffhanger, meaning the final series may feature up to 70 or 80 micro twists, to keep viewers rapt.

Not prestige and not trying to be

There’s a temptation to read these shows as bad television, but it’s a model that behaves more like performance media. Every 90 seconds needs to hook, escalate and summarise, often with a voiceover or a recap. It’s modular, repeatable and attuned to real-time feedback: less a story than a system.

And that system is efficient. Scripts are written in four weeks, shot in eight days and edited in-house. Two-camera setups and minimal locations are standard. Dialogue is often designed for dub-ability, not delivery.

Entire series can be produced for under $100,000. Most sidestep union frameworks, recycle cast and crew, and are creating a new class of actors working exclusively within the format. During the WGA and SAG-AFTRA strikes, when traditional pipelines paused, these shows scaled.

Now, as producers pour money into live sports and pull back from traditional TV and film, these verticals offer a low-cost way to test engagement, build IP or even cast talent, without the upfront risk of traditional development.

Has Hollywood found its next funnel?

Not quite. Vertical dramas may be cheap and scalable, but they’re not necessarily transferable. Most studios still don’t know how to monetise them, or where they belong in the stack. They also present a challenging retrofit for Hollywood’s high production values and guild-protected talent.

The appeal is clear. Micro-dramas are a low-cost, mobile-native content stream, but few studios want to replicate their tone or pacing. And while the failure of Quibi looms large in the industry’s collective memory, the appetite for short-form systems that actually convert hasn’t gone away.

Regulatory scrutiny is increasing, too. In February, China’s broadcast authority introduced formal licensing requirements for micro-dramas, following the removal of over 25,000 titles (1.4 million episodes) deemed ‘pornographic, bloody, violent, low-brow and vulgar.’ As the format grows in the West, questions of platform responsibility and quality control won’t be far behind.

These aren’t just short videos. They’re structured like funnels — built to convert, optimised by feedback, and cheap enough to test in volume. Hollywood sees an audience-builder. Agencies may see a media model. Some media insiders speculate that its uptake is inevitable in a scroll-first world.

ReelShort obviously isn’t replacing long-form content, but it is pressure-testing something the industry can’t ignore: how far you can push a format when feedback, not storytelling, is the organising principle.