More marketers say they’re planning to freeze or cut the amount of money they spend on search advertising, as people increasingly turn to AI tools to find information.

According to Mediaocean’s H2 Market report, the number of marketers who plan to increase spend on search advertising in the second half of 2025 fell 22% compared with H1 — the sharpest decline among the 10 media channels included in the survey.

Only 42% of marketers said that they intended to spend more on search ads in the second half of the year, compared with the 54% who said so in the first half. Meanwhile, the share of respondents that said they would maintain their current spend increased from 42% to 50%, and the amount who said they planned to spend less increased from 4% to 8%.

Mediaocean didn’t ask survey respondents to explain their budgeting decisions, but Karsten Weide, chief analyst at W Media Research, said that the decline is ‘likely driven by consumers’ growing use of AI chatbots for discovery and research.’

At a conference in April, OpenAI’s CEO, Sam Altman, said that ‘something like 10% of the world uses our systems now’, which puts the number of users at around 800 million. (Although Altman’s phrasing suggests he was not just referring to users of ChatGPT but other tools owned by the company, too.)

Google maintains that overall queries for its search engine continue to grow, but at the end of 2024, its market share dipped below 90% for the first time in 15 years, as Microsoft Bing’s increased slightly to 4%, probably as a result of its partnership with OpenAI.

Google’s share price also took a hit in May, after Apple executive Eddy Cue testified in court that Google searches on his company’s devices had declined the previous month, adding: ‘That has never happened in 20 years [the length of time that Google has been the default search engine on Apple products]. If you ask what’s happening, it’s because people are using ChatGPT. They’re using Perplexity.’

Google, of course, has built its own AI tools. In fact, investment bank Oppenheimer last week raised its target price for Alphabet (Google’s parent company) after a survey indicated strong uptake and satisfaction with its AI Mode function, with 60% of ‘knowledgeable’ respondents rating its answers more highly than those of ChatGPT.

That said, it’s important to keep the scale and pace of disruption in perspective. If ChatGPT handles 1 billion searches per day (as one report suggests), that’s still far less than Google, which answers around 14 billion. Not to mention that AI tools field a much broader range of queries, not all of which are comparable to traditional searches.

Similarly, while Emarketer predicts that by 2029 US brands will spend $26bn on AI-powered search advertising, that’s only a fraction of what they spend on regular search advertising today. According to the IAB’s 2024 Internet Advertising Revenue Report, brands spent $102.9bn on search ads in the US last year alone.

The declining interest in search advertising observed by Mediaocean was not orders of magnitude greater than that of other channels, either. The share of marketers who said that they were going to spend less on retail media in the second half of 2025 increased from 6% to 11%, for example.

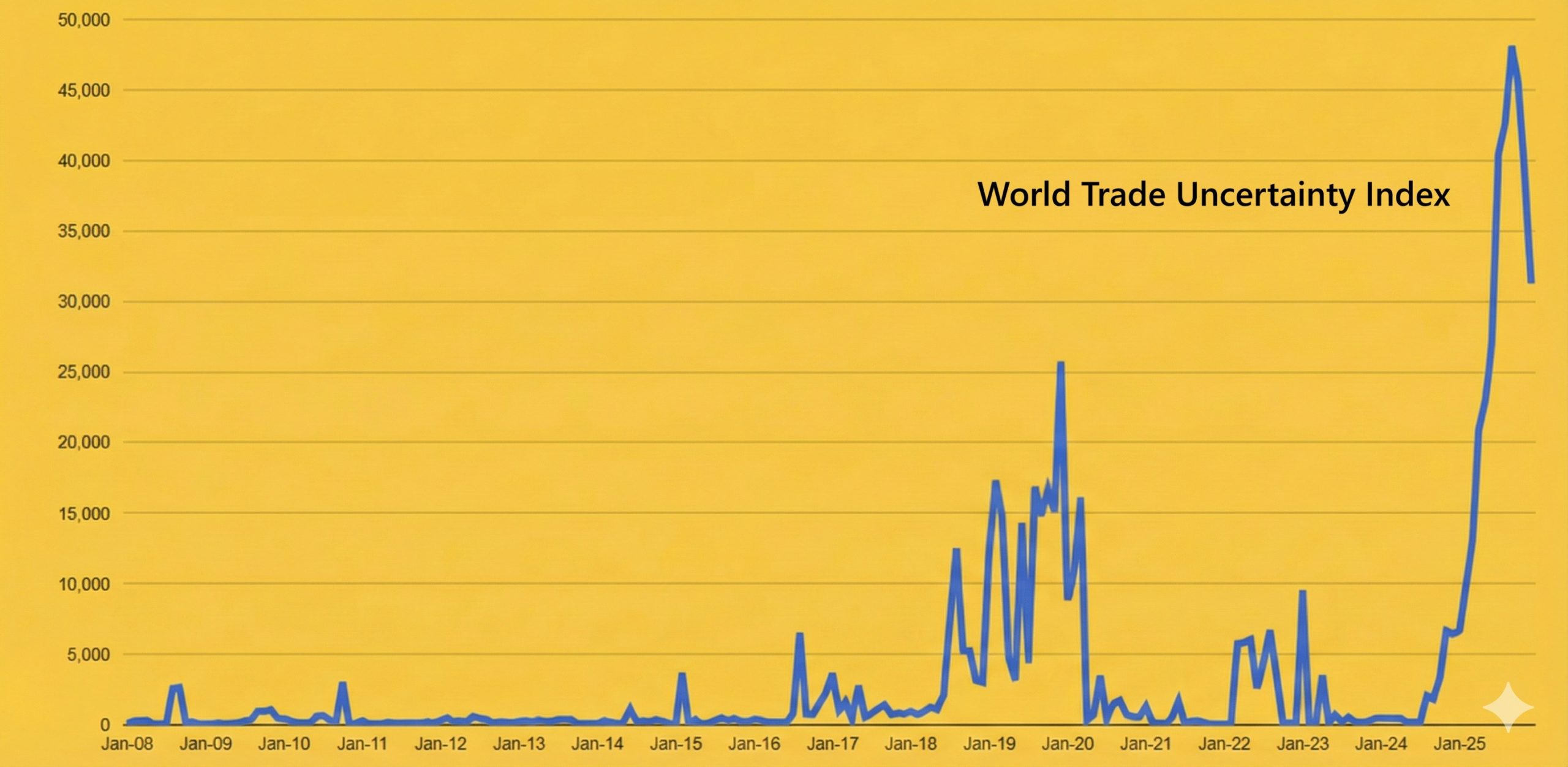

In fact, the number of respondents who said they were planning to spend less increased in seven of the 10 media channels covered by the Mediaocean survey, which most likely indicates a lack of confidence in the economy, rather than a dramatic flight from search.

Mediaocean surveyed almost 500 marketing professionals from around the world in May for its report. CTV was the top-performing channel among marketers, with 58% of respondents saying they were going to spend more on it, and that was only an increase of three percentage points compared with the H1 2025 report.

Performance-driven paid media was voted the most critical advertising capability and media investment for the next six months by the respondents, followed by brand advertising, and then measurement and attribution.

Main image by Christian Wiediger on Unsplash