Kids TV isn’t just keeping young viewers entertained. It’s providing broadcasters and streaming platforms with a safety net.

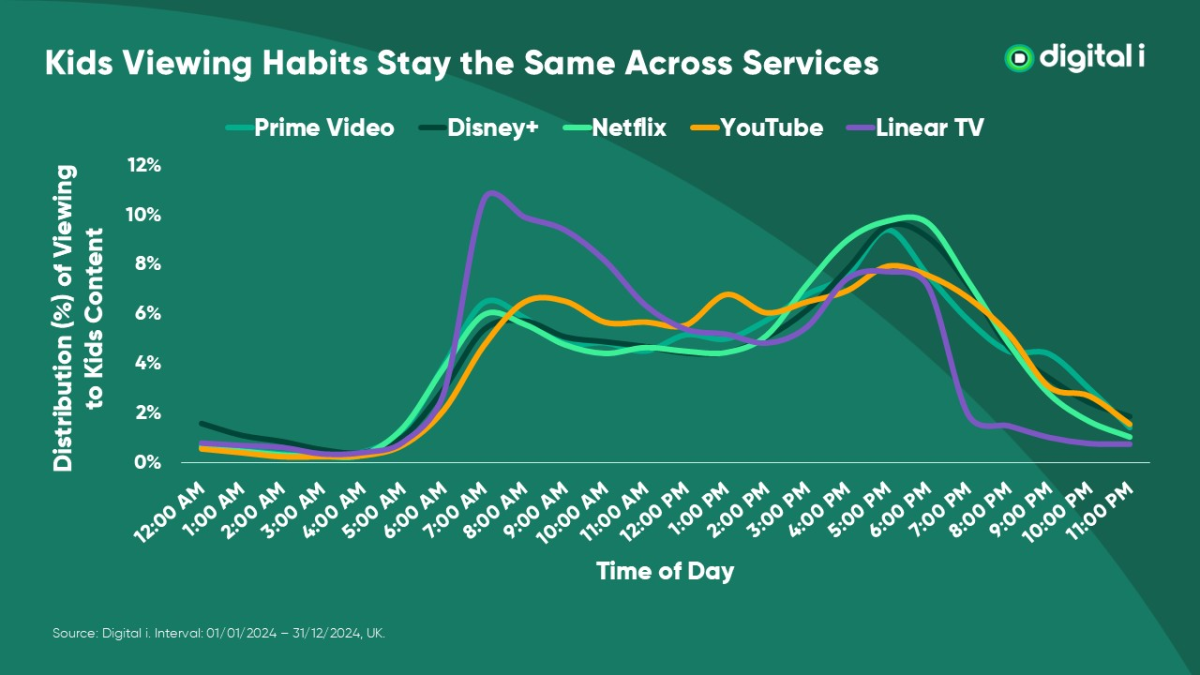

New data from Digital i reveals that the most stable traffic on UK streaming platforms doesn’t come from prime-time hits or algorithmic discovery. It arrives in two daily spikes — 6-9am and 5-7pm — and it’s driven almost entirely by children’s programming.

Kids shows account for just over 10% of all linear TV viewing at 8am, suggesting that ease still matters in the morning. No logins, no fuss, just a quick switch to a familiar channel.

But the research shows that the 5–7pm peak belongs to streaming. In the post-school, pre-dinner stretch, on-demand platforms like Netflix, Prime Video and Disney+ pull ahead of both YouTube and linear, just before adult viewership starts to climb.

For streaming services, that behaviour unlocks something rare: consistency. Kids’ viewing habits are not just repetitive: they’re platform-agnostic. The same daily curve plays out across all services, giving planners a reliable, scalable baseline to build around.

Childrens’ programming also smooths traffic curves, sustains engagement metrics and keeps monetisation engines running during otherwise low-yield windows during the day.

‘Kids’ content drives a huge amount of engagement because kids watch it over and over and over and over. They never tire of it,’ Kevin Mayer, co-CEO of CoComelon parent Candle Media, told CNBC. Which is helpful, given that prestige content tends to be the opposite: high cost, short life and even shorter loyalty.

These viewing habits keep titles surfaced in trending carousels without the need for fresh marketing spend. As far as discoverability goes, that makes kids’ content self-sustaining.

No parent wants to cancel the platform that gets their toddler through breakfast, either. And with subscriber losses growing faster than sign-ups, reducing churn is a survival metric. According to measurement firm Antenna, the average gross churn rate for premium SVOD services hit 5.8% in Q3 2024 — the highest since tracking began. Monthly cancellations routinely exceed 6% across top platforms.

While platforms tweak price points and ad tiers to retain adult customers, kids’ content — with its daily utility and emotional stickiness — offers exactly the kind of friction that keeps households locked in.

It’s also commercially efficient. Kids’ shows are far cheaper to produce, easier to localise and faster to syndicate across markets. Even one modest season of animation can amortise across years of rewatching by riding those daily peaks, with added upside from licensing, merchandising and global distribution.

And when the formula clicks, the upside isn’t modest at all. Bluey’s thriving licensing business helped the BBC’s commercial arm hit record revenues of £2.2 billion in 2024/25.

The show now reaches 40 million people weekly, in 17 languages. Its global licensing programme spans toys, books, games, live experiences and apparel, with more than 20 partners in the UK and a long runway across North America and EMEA.

While that kind of revenue can’t fully offset the BBC’s broader funding shortfall, it shows how children’s IP can punch well above its budget. It’s franchise-ready IP: built for repetition and monetised in formats that prestige originals rarely reach.

That logic is shaping strategy on other platforms too. YouTube has become a first-run channel for kids’ IP. Netflix, even after losing CoComelon, acquired Ms. Rachel and new seasons of Sesame Street. Disney+ continues to double down on both core IP and licensed hits, with titles like Bluey, Frozen and Moana 2 — the latter clocking over 27 million global views in under a week.

This isn’t genre expansion. It’s risk management. In a market where most originals age fast and cost more, kids’ content offers something rare: a commercial architecture that works across quarters, formats and revenue streams.

Contrast that with the volatility of adult-facing originals. Shows like Squid Game and The Night Agent may rake in millions of views upon release, but they don’t offer the same kind of retention insulation. They’re expensive, unpredictable and — crucially — finite. After all, nobody’s re-watching The White Lotus the way they are with Peppa Pig.

Kids’ content isn’t glamorous. It doesn’t dominate Twitter discourse or sweep awards season. But it does something arguably more important: it delivers reliable, repeatable, scalable engagement across time zones, households and devices. It keeps the lights on when everyone else isn’t watching at home.

The most effective streaming strategy today might be appealing to an audience that can’t pronounce ‘streaming strategy.’ And that’s fine. They’ve got the numbers to do the talking.

Featured image: RDNE Stock project / Pexels