The final quarter of this year will be tough. Not impossible — but probably tougher than anything we’ve seen in recent memory.

Why? Because the market is jittery, buyers are cautious, and competition is fierce. Deals will still get done. Growth will still happen. But only for those founders and leaders who are prepared.

Let’s be clear: AI is not the answer on its own. Every business is investing in it, and rightly so. But treating AI as a silver bullet is a dangerous distraction. The fundamentals of business haven’t changed: revenue, resilience, and relationships.

And right now, the smartest play isn’t just doubling down on AI — it’s doubling down on new business and sales.

The Q4 Reality Check

- Budgets are tight: procurement teams will push harder than ever.

- Clients are restless: switching costs are falling, and loyalty is fragile.

- Deals are harder: valuations are under pressure, buyers more demanding.

It’s Darwinian out there. The companies that thrive in Q4 won’t be the ones with the flashiest AI demo. They’ll be the ones winning new logos, protecting margins, and keeping their pipeline warm.

What Leaders Should Do Now

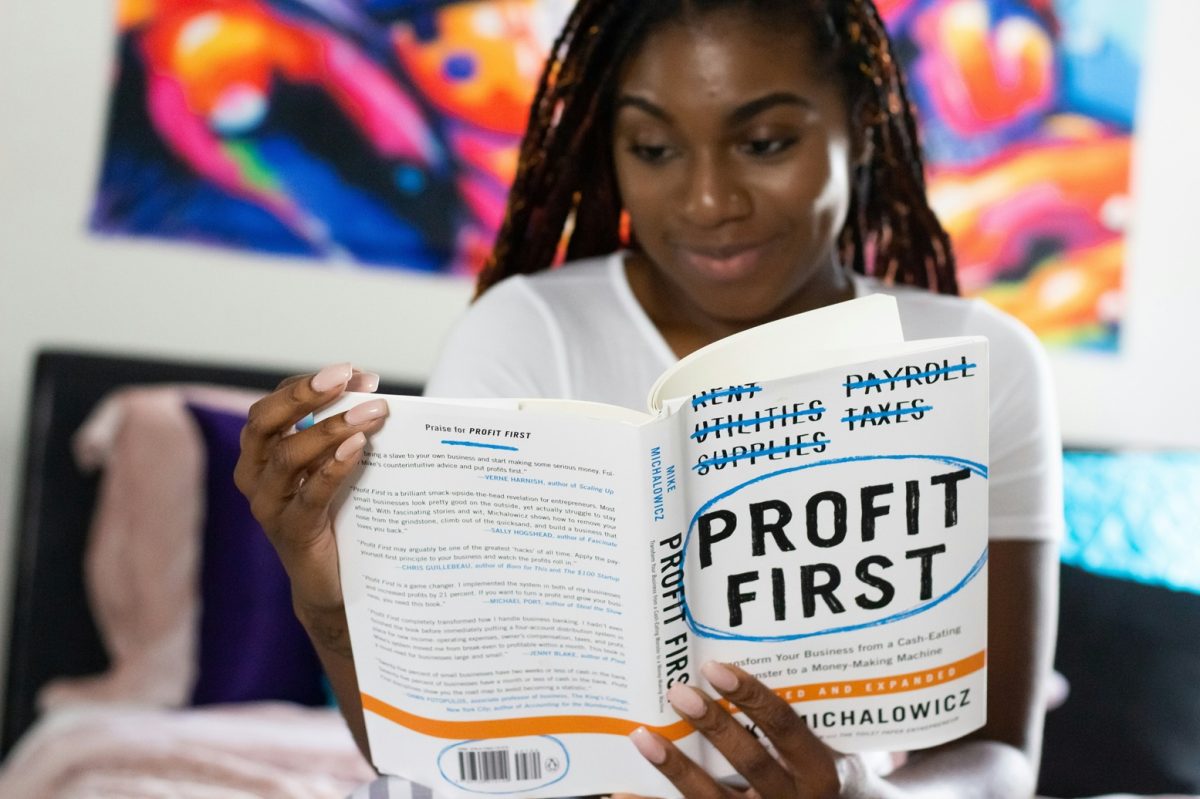

- Get forensic with your numbers: Know your margins, churn, and client lifetime value cold.

- Systematise sales: Don’t rely on a couple of rainmakers; build a repeatable engine.

- Protect and grow clients: Expansion revenue is just as important as new wins.

- Stay deal-ready: Clean financials and optionality matter. If opportunity knocks, you should be able to open the door without breaking a sweat.

Why This Matters

We’re already seeing it in our world of M&A. The businesses getting acquired right now aren’t those with the trendiest tech story. They’re the ones with resilient revenues, tight reporting, and leadership focused on value creation.

Yes, invest in AI. It’s here to stay. But don’t bet your Q4 survival on it. The winners in this market will be those who sell smarter, protect harder, and prepare better.

Because when the market turns — and it will — only the ready will reap the rewards.

For more insights on growth, sales, and M&A readiness, visit ryanpartners.co.

Main image by Natasha Hall on Unsplash